However, depending on your skill set and interests, one franchise may be a better fit than the others. Some of the key perks of starting an accounting franchise are that you have a proven business model and a respected name behind you from day one. This takes a lot of the guesswork out of starting a successful business for new business owners. Some accounting franchises specialize in one category while others may offer a suite of services.

About Paramount Tax & Accounting

Before you decide to buy an accounting firm franchise, check out the availability of the funds required to pay entry and ongoing costs. In summary, franchises have special accounting needs related to revenue reporting, royalty fee collection, marketing fee payments, and routine financial reporting. By addressing these specific requirements, franchise businesses can maintain accurate financial records, meet contractual obligations, and ensure the successful operation of their franchise locations. Franchise accounting requires proper record-keeping and financial management to ensure compliance with both the franchisor’s guidelines and any legal and regulatory requirements.

Liberty Tax: Best for Tax Preparation and Filing

In summary, franchise accountants provide valuable guidance to franchisees by regularly reviewing their debt structure and seeking lower-cost options. By effectively managing debt, franchisees can optimize their business performance and achieve sustainable growth. Franchise owners are typically required to pay ongoing royalty fees to the franchisor, which is a percentage of their revenue. Accounting systems should be in place to track and collect these fees and ensure they are accurately recorded in the financial statements. Franchisees usually start their business journey with a considerable investment. This includes the initial franchise fee and other startup costs like leasing a location or stocking up on inventory.

Ready to Get Started?

With our proven business model, you won’t have to worry about the uncertainty and risk that comes from opening your own business. Succentrix Business Advisors has created a new and comprehensive franchise model for next generation accountants, operating income vs net income cloud-based and interconnected. Succentrix Business Advisors offers tax preparation, payroll and business support services to other entrepreneurs. In other words, it helps people to fulfill their personal and professional dreams.

A CPA can do things an accountant can’t, such as send your tax returns to the IRS. Understanding CPA compensation and benefits can help you decide whether hiring a CPA is the right option. At Gatlin Rago CPA Group, a local Valparaiso CPA Firm, they hdma returned goods debit memo template have staff dedicated to providing accounting and tax services to franchise businesses. Whether you are a seasoned franchisee or exploring the feasibility to become one, Gatlin Rago CPA Group will manage all the financial needs of your franchise(s).

Accounting for franchises

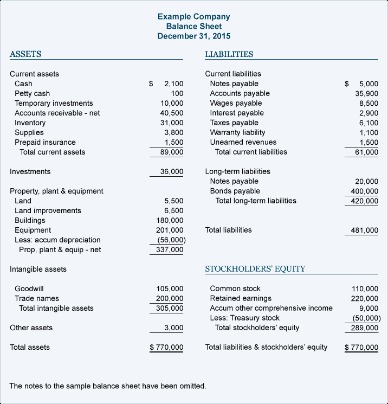

A balance sheet is a financial statement that shows a company’s assets, liabilities, and equity at a particular time. It provides insights on a franchise business’s financial position and helps to track changes in assets and liabilities over time. It’s essential to maintain accurate balance sheet records to evaluate the franchise’s financial health.

Additionally, you’ll have access to P3’s world-class training, coaching, marketing resources, and other forms of support. SAS helps both the Franchisee and Franchisor focus on the drivers that make them more profitable. Our firm uses technology to optimize our ability to analyze financial results and communicate with our clients.

Proper accounting allows them to track and analyze the performance of their franchise locations, identify areas for improvement, and plan for future growth. Furthermore, most accounting franchises require minimal to no employees to build a successful business. When you consider the many overhead costs and the number of employees needed for other types of businesses, starting an accounting franchise is quite appealing.

An ideal candidate should have strong people skills and a desire to network with other business owners. Therefore, you can produce recurring revenue that is somewhat predictable each month. Since you’ll be working with many of the same clients each month, that saves you from having to continually find new clients to meet your profit goals. In this article, we will explore what an accounting franchise is, the benefits of starting an accounting franchise, and provide a list of the best accounting franchises you can start this year.

If your franchise requires employees, they can manage payments, expenditures and tax reporting. When it comes to the most important factor — cash flow management — they can help by structuring available capital according to your operating budget. Busy Bookkeeping is a growing national network of professional bookkeepers who focus on providing bookkeeping services to small and medium businesses, and to Accountants in Public Practice. Busy Bookkeeping is a franchise business that was founded over 10 years ago, and now extends throughout Australia, with some 60 franchises in operation. The bookkeeping and payroll services industry has loads of small business operators servicing a wide range of clients, ranging from startups to well established businesses. Basically, bookkeeping and payroll firms offer outsourced payroll services for clients’ employees.

- We need to consider factors like foot traffic, accessibility, and proximity to other businesses.

- This continuous improvement ensures that we can provide the best possible service to our clients and stay relevant in a rapidly changing industry.

- Even if you decide to outsource your books to an accountant, payroll software for accountants could drastically decrease the financial burden on your overhead.

- This expert guidance is key to helping franchise owners make informed financial decisions and maintain the financial health of their businesses.

- From branded materials to digital marketing strategies, we have everything we need to attract and retain clients.

- A vast majority of accounting franchises offer franchisees the opportunity to run their business online — i.e. from a home office or other remote location.

One thing for certain is that businesses will always need help preparing and filing their taxes. By becoming a franchisee with Liberty Tax, you’ll be able to enter this lucrative field while leveraging its 25 years of experience in tax-related services. In addition, we work with your franchisor to understand how to best use the tools and systems they have in place to help your operation flourish. Our clients maintain great businesses and our role is to ensure they continue to do so.

Liquid Capital understands what it takes to be successful for small and medium-sized businesses because they are small businesses themselves. Liquid Capital finances companies that want to grow their business through additional cash flow. They also offer a full suite of accounts receivable management services including credit checks, professional fees, and online reporting tools. In business since 1999, Liquid Capital has more offices in North America than any other trade finance company and continues to grow at a market-leading pace. TFMC is a leading financial management consultancy that provides full accountancy & bookkeeping services to businesses throughout the UK.

We should look for individuals who not only have the necessary qualifications but also fit well with our company culture. A strong team can make a significant difference in the success of our franchise. In short, it’s not entirely necessary to hire an accountant, but it can end up saving you a lot of trouble, time, and potentially money in the long run. Some of the things you’ll need to keep track of include employee scheduling and salaries, rent, utility costs, and raw material costs. For the most part, franchise accounting is the same as non-franchise accounting, but there are a few idiosyncrasies you need to keep in mind. Having a partner you can trust with your financials gives you the time and confidence to manage the rest of your business with the peace of mind that your financials are in order.

When it comes to choosing a location for your accounting franchise, location is key. We need to consider factors like foot traffic, accessibility, and proximity to other businesses. A well-chosen location can set your franchise up for success from the start.

By staying flexible and open to change, we can adapt our services to meet new demands. This might involve exploring new service offerings or adjusting our business model to better align with current market needs. We have access to a network of fellow franchisees who share their experiences, challenges, and successes. This community is invaluable for brainstorming new ideas and finding solutions to common problems. If you’re new to entrepreneurship and need help getting started with accounting for your franchise, you’re in the right place. Here, we’re going to cover everything you need to know about franchise accounting, including how to do it yourself and how to know if you need to hire a professional.

This includes having up-to-date financial statements, ensuring compliance with all government regulations, and maintaining accurate records of all sales and expenses. As a franchisee, you are also required to provide an annual report to the franchisor that outlines your financial performance for the year. When it comes to franchise accounting, sticking to a budget is crucial for maintaining good cash flow. A budget allows franchise owners to plan and allocate their financial resources effectively, ensuring that expenses are controlled and revenues are optimized. Franchise accountants thoroughly analyze the debt structure, including outstanding loans and interest rates, to identify opportunities for refinancing or negotiating better terms with lenders. Franchise agreements often require franchisees to contribute to marketing funds.

To effectively monitor cash flow, franchise owners can utilize a cash flow dashboard. This dashboard provides real-time visibility into cash transactions, allowing for proactive management of expenses and revenues. It helps franchise owners stay on top of their financial position and take timely actions to ensure good cash flow. By working with a professional franchise accountant, franchise owners can focus on running a successful business while leaving the complexities of franchise accounting in capable hands. Franchises need to clearly report revenue from contracts with customers, which includes income generated from the sale of goods or services.

We have availability for new locations in most markets in the United States. For more information, please call us or download our franchise report using the form below. Over the past 4 years, we have doubled the number of Paramount Tax and Accounting franchise locations across the United States. Our franchisees’ unmatched success has been paramount to our expansive growth. Please keep scrolling to learn more about the benefits of franchising with us. Taxes can be a headache, but they’re a necessary part of running a business.

Accounting processes should be established to track and manage these fees, ensuring their proper allocation and appropriate use to promote the brand and support marketing initiatives. In summary, a franchisor is the entity that owns the rights and licenses to a brand or business, granting franchise licenses to third parties, known as franchisees. It oversees the management and growth of depreciation definition the brand while relying on individual owners to operate and grow each franchise location. As mentioned earlier, some accountants have specific knowledge and expertise in franchise accounting, so they can ensure that you get your business started on the right foot. What’s more, you can even hire accountants who have experience with your brand in particular, which can prove invaluable.